After decades in which China felt like a one way bet for European firms, market conditions have become far more challenging due to restrictive COVID-19 policies, slowing economic growth and rising geopolitical tensions. Against this increasingly uncertain backdrop, we have taken a close look at European (EU+UK) FDI in China to assess the current state of investment on the ground, and shed light on how it has evolved over the past decade. Our key finding is that European investment has grown much more concentrated, both in terms of the companies that are investing there, the countries they come from, and the sectors in which they operate. While a handful of large firms, many of them German, continue to pour money into their China operations, many other firms with a presence in China are withholding new investment. At the same time, virtually no new European firms have chosen to enter the Chinese market in recent years. And acquisitions of Chinese firms have stalled, with greenfield investments increasingly dominating the FDI landscape.

Our findings point to a widening gap in how European firms perceive the balance of risks and opportunities in the Chinese market. They also suggest that a more nuanced perspective on the issue of European corporate dependencies is needed. From a direct investment point of view, it is wrong to talk about a broad-based dependence of European, or even German, companies on the Chinese market. As policymakers in Berlin and other European capitals consider measures to reduce economic dependence on China, they would be wise to take the growing concentration of corporate risks into account.

The Chosen Few

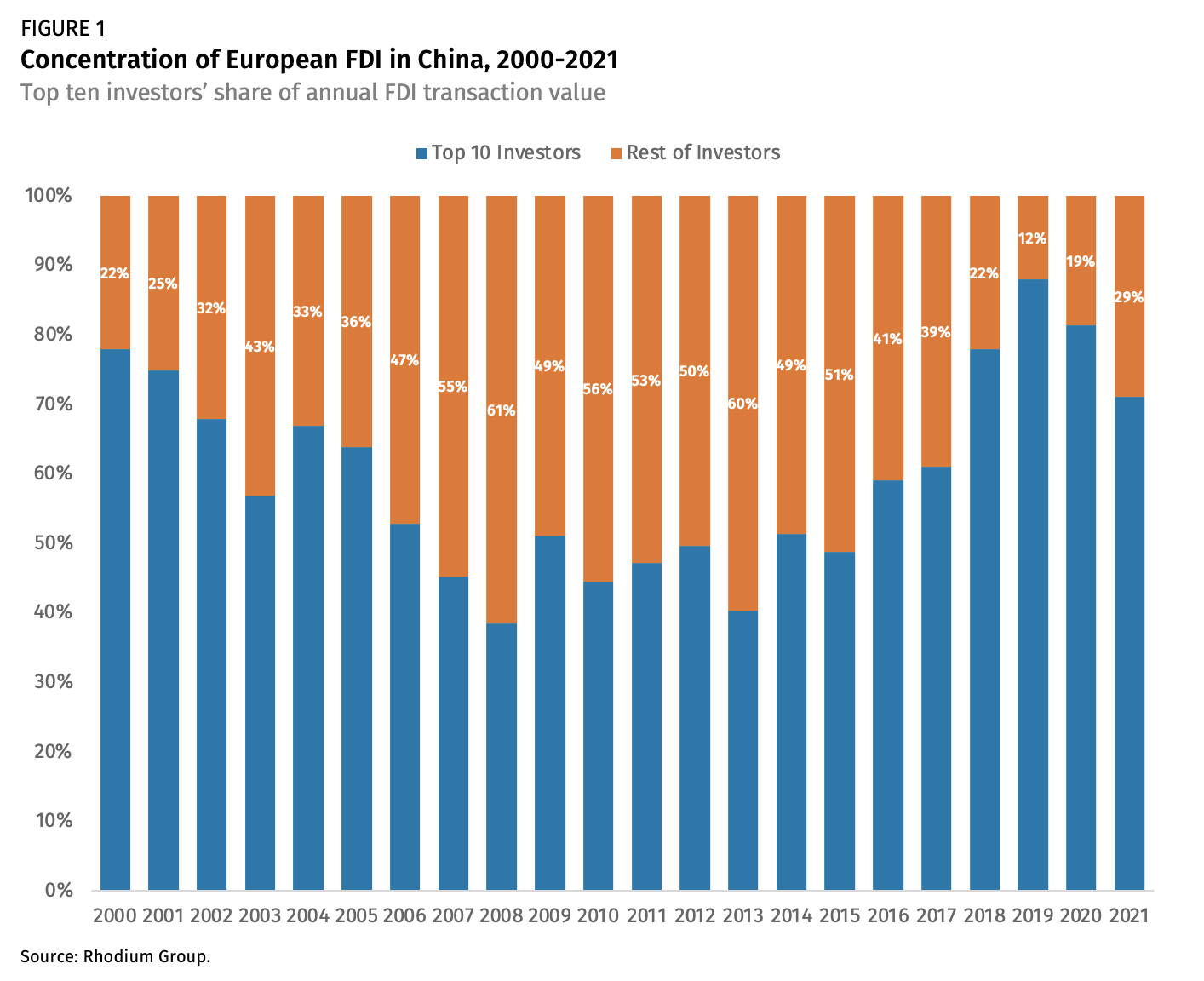

Our review of core trends in European FDI to China over the past decade has yielded one especially striking finding: today, the overwhelming majority of European investment in the country comes from just a handful of companies. We find, for example, that the top 10 European investors in China in each of the past four years made up nearly 80%, on average, of total European direct investment in the country. In 2019, the trend toward greater concentration was especially marked, with the top 10 investors representing 88% of all European FDI (see Figure 1). In comparison, over the previous decade (2008-2017), the top 10 European investors in China made up just 49%, on average, of the total European investment value.

European investment has also become more concentrated in terms of sectors. Five sectors—autos, food processing, pharma/biotech, chemicals and consumer products manufacturing—now make up nearly 70% of all FDI, compared to 57% in 2008-2012 and 65% in 2013-2017 (see Table 1). Among them, the auto sector stands out. It now consistently represents about a third of all European direct investment in China. This proportion was even higher in H1 2022 as German carmaker BMW increased its stake in its China JV from 50% to 75% and other European automakers poured money into new facilities to build electric vehicles.